Augur Weekly - Critical Moment for Impeachment Markets

A Look at the Week in Political Betting, Augur News, and More

Augur Weekly posts are public. If someone you know might like it, feel free to share!

Political Betting Roundup

This week, the impeachment hearings for President Donald Trump’s inquiries into Joe Biden’s son in Ukraine, and the alleged quid-pro-quo, brings markets affected by its result into focus. Wednesday featured testimonies from William B. Taylor Jr., acting ambassador to Ukraine, and George Kent, deputy assistant secretary of state for European and Eurasian affairs. No smoking gun emerged from these initial testimonies, and the betting markets remained relatively unchanged; leaving bettors hoping to profit from a volatile soundbite wanting. Today features further testimony from former ambassador to Ukraine, Marie L. Yovanovitch.

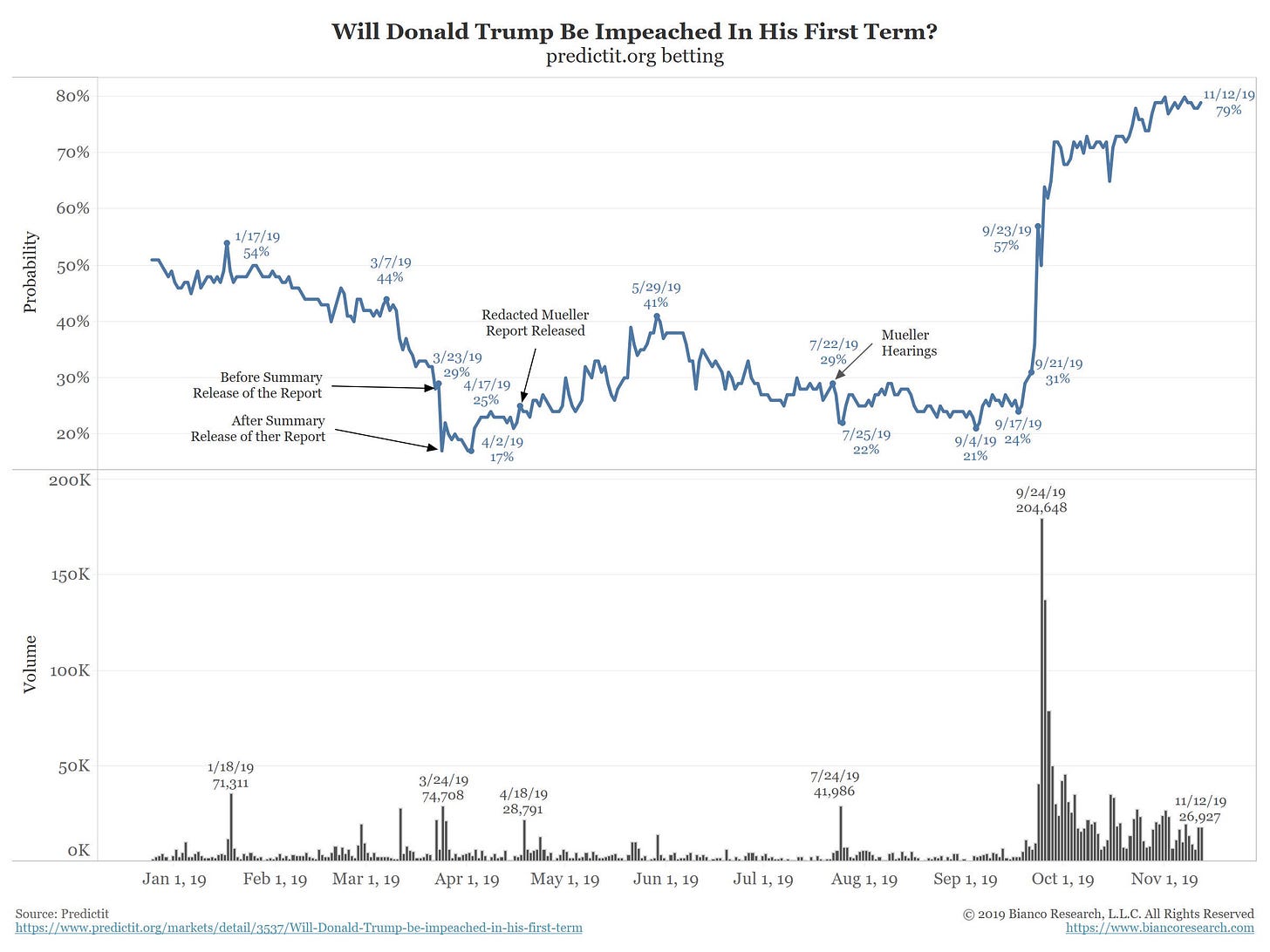

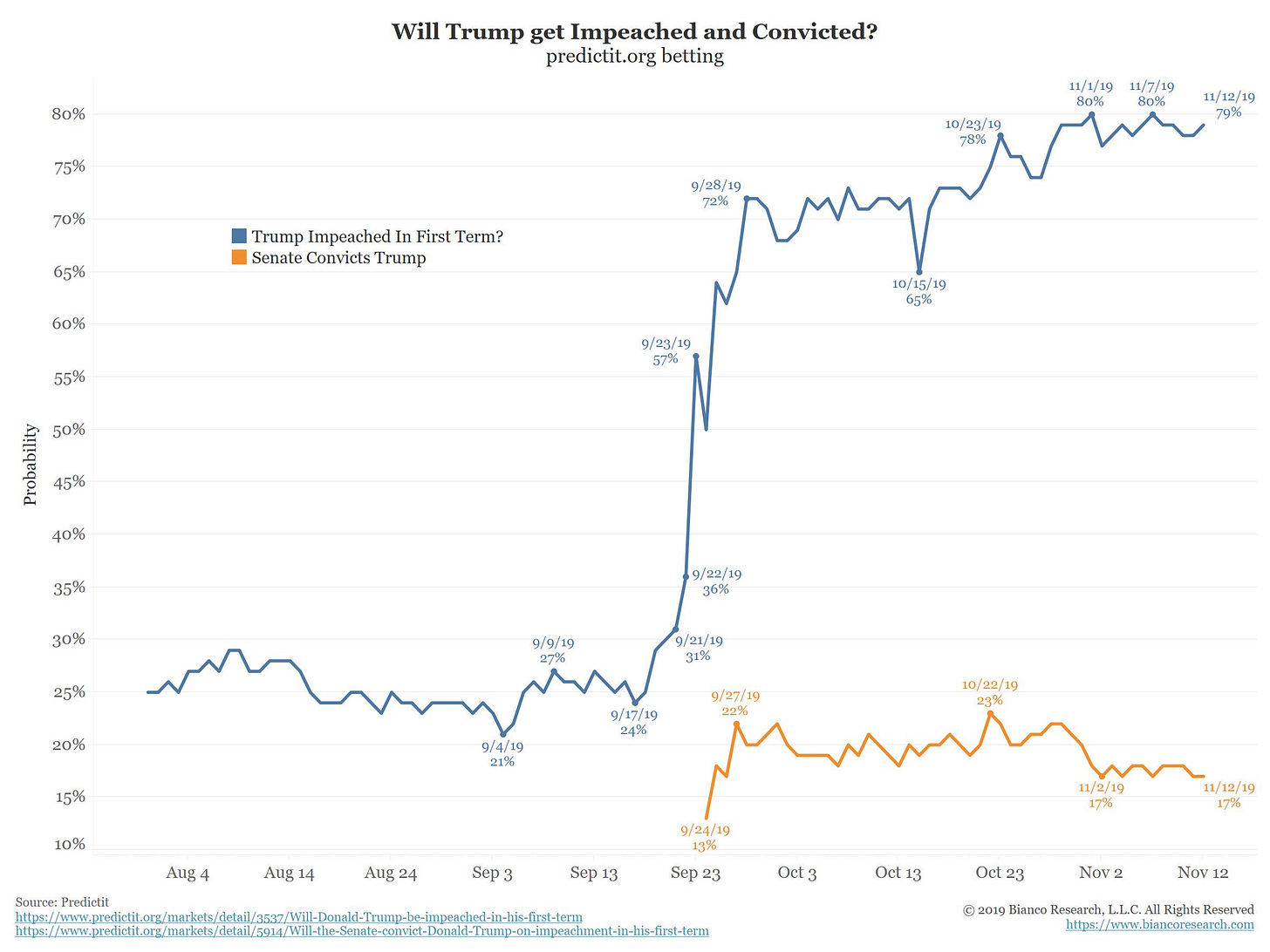

As you can see in the above chart from Jim Bianco Research, the PredictIt odds for Congress passing an article of impeachment have been steadily trending upwards since the initial spike when Nancy Pelosi announced her inquiry (Currently 0.77/share). While odds are quite short, representing the market’s belief that the passing of at least one article of impeachment is inevitable, a dissenting thesis can earn ~3.3x on their money if correct.

Although the odds of impeachment are quite short, the odds of a Senate conviction remain long in contrast. Given GOP control of the senate, the betting public believes that would be a long shot (currently 0.17/share). Like the market on impeachment, a contrarian here stands to earn a substantial return, ~5.9x, for a correct prediction.

Elsewhere in political betting news, the markets for the Democratic nomination continue their week-over-week volatility. After making an initial splash with his announcement, Mike Bloomberg’s odds have fallen back to earth from 0.13/share to 0.06; while his theoretical competition for the moderate voting base, Pete Buttigieg (0.19/share) and Joe Biden (0.23/share), seemed to have regained their lost footing. What’s more, not only did this recovery put distance between Buttigieg/Biden and Bloomberg, but it also added some separation from Bernie Sanders and Andrew Yang, the owners of the fourth and fifth-best odds at 14c and 9c, respectively.

The most notable story in the Democratic nomination market, however, is Elizabeth Warren’s continued fall from bettors’ grace.

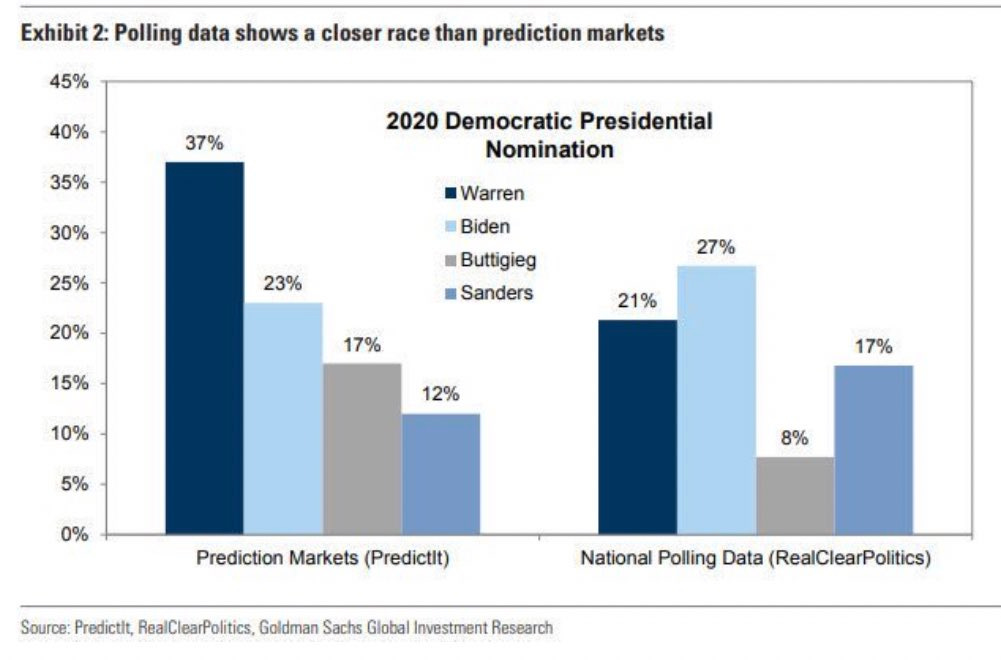

Warren’s early October odds painted her favorite status as a foregone conclusion. However, as we’ve noted here, sentiment this far out tends to be fickle. What’s also interesting to note, at this point, is the dichotomy between polls and markets. While a recent post (bonus: fun prediction market math discussion in the comment section, if that’s your thing) paints markets as being driven by poll sentiment, the divergence captured below suggests otherwise:

David’s right, Sportsbooks are certainly going to have disadvantageous odds and pricing relative to prediction markets. Couple that with the inability to exchange your position and it becomes clear that buying a ticket is the suboptimal route.

As a reminder, come Q1 2020, Augur will be the only platform for political betting with no limits, the lowest fees, and unbeatable odds.

To receive updates on Augur including this newsletter, sign up below:

Further Reading:

Augur Edge - Ben Davidow

These gamblers are putting money on the outcome of the impeachment inquiry - Washington Post

Hot Augur Markets

Provided by: Augur Digest

UK General Election: Overall Majority Of Parliament Seats?

48 ETH | $8,876 | Dec 16, 2019

Will Elizabeth Warren be polling over Bernie Sanders by the end of November?

115 ETH | $21,247 | Dec 1, 2019

Will Donald Trump be Re-Elected in 2020?

71 ETH | $13,009 | Dec 5, 2020

Closing Price Of ETH/USD At The End Of November UTC?

5 ETH | $939 | Dec 2, 2019

Around the Ecosystem

More on Augur

Augur v2: A Tour of the Prediction Protocol’s First Major Upgrade

The Ultimate Guide to Decentralized Prediction Markets

Announcing the Augur v1 Cutoff

The Forecast Foundation has no role in the operation of markets, trades or actions created or performed on the Augur protocol, nor does it have the ability to censor, restrict, control, modify, change, revoke, terminate or make any changes to markets created on the Augur protocol. The Forecast Foundation has no more control over the Augur protocol than anyone else using Ethereum.

Thus, we do not seek to advise others on how to use the protocol. We encourage those in the community that are well educated on Augur to pay it forward and share their ideas for best practices, tips, fixes, etc with the larger community via Twitter, Discord, Reddit, Github, and other community channels. For more information regarding the role of the Forecast Foundation, check out the FAQ.

Cheers,

The Forecast Foundation OU